|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#1 |

|

Member

|

Going to try this, if it gets merged, then it is what it is.

A little about me - I have been trading options for about 6 years now. 3 years of seriously learning and educating myself on them, testing multiple systems out - and the 3 years prior to that I was doing what most people I've spoken to here were doing - just "winging" my way through it. This is my full time "job" - I take what I'm doing very serious and I don't YOLO or "well, I think this might work" into trades. Every trade I take is A+ and I have reasons for taking it. Aside from trading options, I do have a real-estate portfolio (rental properties) that I maintain on the side and every now and then I help my wife with her eBay/Amazon business. You should always have multiple streams of income, don't depend on just one. Why do I do this? - Because I was afforded the same opportunity a few years ago for free. So I'm just giving back because this was a life changer for me. It allowed me to leave the "9-5" and spend more time with my family & friends. It has allowed me to live financially free and I'm not on anyone's schedule but mine. As I've stated many time here, I want to see people win. I know especially right now it's tough times out there, so learning a new "skill" could potentially help people out. Education will always be free. I don't need your $200/mo. I do this every morning and I enjoy it, so it's not like I'm being stopped from doing something else. Red days/losses - I get asked this a lot. Yes, I do take losses but it's very rare. There's a reason for that, I only take A+ setups and I don't swing anything in the current market conditions. When I get in a trade, I'm in & out, I don't swing right now and I don't hold losers for hope. Keep losers small and let your winners run. That said, I will be posting my ideas here. They are my ideas and no one should be blindly following them. Don't be lazy, use them as a guide and put in the work to educate yourself on Options. There are no shortcuts. Everyone who is serious should start by reading "Trading in the Zone" by Mark Douglas. You won't be successful at this if you don't have the right mindset and discipline. There are no shortcuts. As always, if you want to contribute feel free to add anything to this thread - questions/comments/ideas and so on or if you prefer DM's, my DMs are always open - just give me time to reply as I do have other stuff going on. |

|

|

|

|

|

#3 |

|

Member

|

Perfect.

Mods, don't merge.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#4 |

|

Banned

Join Date: Nov 2015

Posts: 15,578

|

I don't do this type of trading but always appreciate the posts you make. It's fascinating to read about a person with command of an area discuss the topic.

|

|

|

|

|

|

#7 |

|

Banned

Join Date: Dec 2012

Location: Texan in AZ

Posts: 44,115

|

I'm just here rooting for underdogs.

|

|

|

|

|

|

#8 |

|

Member

Join Date: Dec 2013

Posts: 774

|

I appreciate what you are doing Blazed. This stuff is way over my head and, honestly, my day job doesn’t allow me the time to deep-dive it, but I think it’s great you are so willing to share advice and tips on your way of making money in the market.

|

|

|

|

|

|

#10 |

|

Member

Join Date: Feb 2021

Location: Toronto, Canada

Posts: 319

|

Interesting stuff!

|

|

|

|

|

|

#11 | |

|

Member

|

Quote:

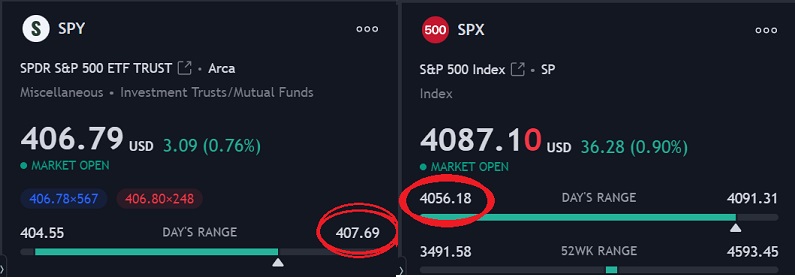

Calling it a day here. The trade once again took way longer than it should have. We had a long slow grind up but we made it to my reject level. SPX: 4050 key level (4060 resistance)✅ - calls at the break above 4060 with volume and trend confirming. SPY: reject area 407.5✅ - rejected 407.5 area as expected. All out.   What I saw: Entered calls @ the break above 4060 and held as long as we were holding support and the daily trend was still up. Volume confirmed we were in an up trend - only had the one fake out candle to shake people out - and I made a full exit @ my SPY reject 407.5. I did not grab puts at the top. I've been watching and it looks like they will slow grind down - maybe dump EOD? Sellers have been stepping in so SPY should go down and test VWAP around 406. Hope everyone enjoys the rest of their day. Back at it Monday.

|

|

|

|

|

|

|

#13 | |

|

Member

|

Quote:

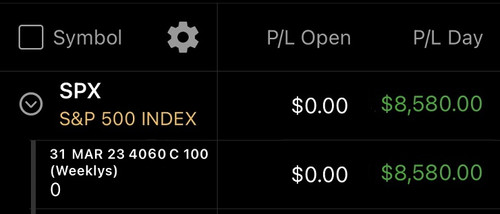

Insane rip up! We did go back and test 406.7. The premise for this pump is that when people buy puts, dealers go short. If those puts decrease in value, dealers can decrease how short they are and that can lead to increased buying in the market. Basically the catalyst is liquidity from a very over hedged market and then the downside protection decaying lead to positive delta decay allowing market makers to buy the market up.

|

|

|

|

|

|

|

#14 |

|

Banned

Join Date: Dec 2012

Location: Texan in AZ

Posts: 44,115

|

Honest question: To what extent are the fluctuations that you are attempting to capitalize on based in changes in real-world assets and corporate developments and to what extent are they based on the excesses of human emotion and algorithmic blind spots?

|

|

|

|

|

|

#15 | |

|

Member

|

Quote:

Blazed, from what I understand the underlying securities that an option contract represents is moved based on the value of the options not the actually security? I think I learned that watching a video on YouTube for a channel called Project Finance, I may have heard that incorrectly or maybe you said it? I don't want to put words in your mouth and if what I said is wrong I'll throw it in the trash.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#16 |

|

Member

Join Date: Jan 2009

Posts: 49,047

|

Just tell me what to do.

|

|

|

|

|

|

#17 | ||

|

Member

|

Quote:

Quote:

Options are moving the market, not the other way around. This is a market maker market right now, most retail traders don't understand how options can move markets via delta hedging by the big boys (market makers, banks, dealers). If you want to see it in action, watch the options contracts on SPX during the last 10 min of the trading session. Dealer hedging and MOC's rebalancing final hedges of the day. Huge volume all done by software. Contracts can go from $40 ---> $2000+ in 5 - 10 mins. Not every day, but on days they decide to pump or dump with huge volume. Some days they close the session flat, just depends on their hedges for the day/week. |

||

|

|

|

|

|

#18 |

|

Member

|

Bottom 4050, Top 4150 (weak resistance 4120?), Key Level 4100

SPY bouncing off Friday close in the pre-market.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 04-03-2023 at 08:26 AM. |

|

|

|

|

|

#19 |

|

Member

|

A lot of strong buy signals so consolidation and a move up might be in play before we start seeing some downside. Anything can change so no bias.

SPX: 4150 top / 4050 bottom (4065 resistance) / 4100 key level (4060 resistance) - SPX also has a gap @ 4030 from last Thursday. Watching: SPY bounce 406.7 and 406 (higher probability) SPY reject 414-415 area SPY needs to break 410 for more upside. Will watch around 409.5-410 for a reject in the mean time. Also watching USOIL and oil stocks based off the oil news over the weekend. |

|

|

|

|

|

#20 |

|

Member

|

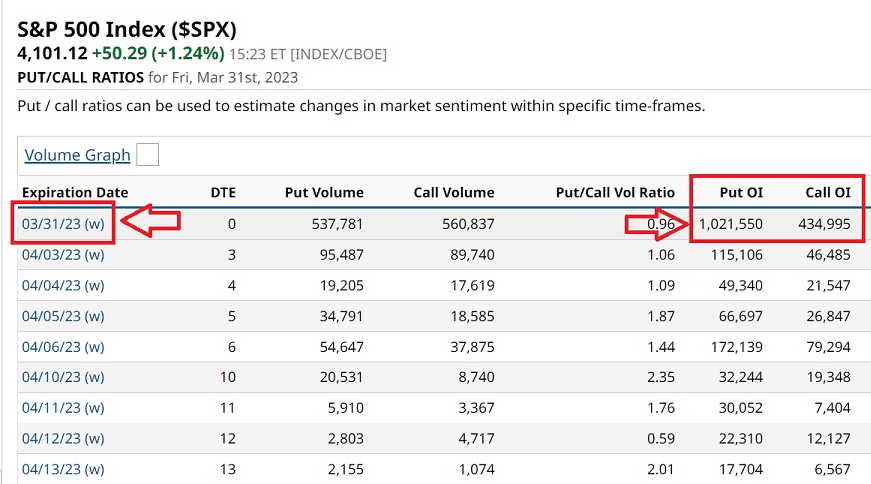

Took 4105 Calls based on volume coming in, SPY breaking above previous close (rejected all morning in premarket), strong buying above BB and VWAP.

Admittedly blazed saying their is strong buying signals was a reason to, which isn't bad, but I need to see more of this on my own. Blazed could you provide more insight to your buy signals after trading? Sold 4105 Calls for $830 profit. SPY was just not getting past 410. I'll monitor throughout the day and see if this was an early exit. I'm happy either way, good position, nice gain. Volume was showing to hold however. It appears now, at 10:23, we may have broken through 410, now I would expect to look to the rejects Blazed had from this morning. Would have been a great day to immediately take Puts at the reversal and ride them down.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 04-03-2023 at 10:11 AM. |

|

|

|

|

|

#21 | ||

|

Member

|

Quote:

Quote:

------- 411.5 on SPY is the next big level it needs to break above. |

||

|

|

|

|

|

#22 | |

|

Member

|

Quote:

I considered that it opened above the Key Level, but not so much the actual bounce off the first 5m candle.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#23 | |

|

Member

|

Quote:

I like the days where things move quick. Calling it a day here, the premarket plan played out - we got the move up then the nice sell off after as expected. Hope everyone enjoys the rest of their day. a lot of strong buy signals so consolidation and a move up might be in play before we start seeing some downside✅- played out perfectly. Spx: 4100 key level✅- bounced it almost to a T. 411.5 on spy is the next big level it needs to break above.✅- (4130 SPX) rejected this area, couldn't break it. Where did I get this level? Daily chart - 411.5 played support/resistance the first half of Feb. SPY needs to break that level before we see any moves higher.    Education: Took calls off the open @ the 4100 bounce - market looked strong and it was key level support. Watched how we did @ SPY's 410 area (volume confirmed we had more upside), then watched how we did @ the 411.5 area. We were losing momentum heading into 411.5 and sellers started stepping in. After the 3rd reject of that area on SPX (2nd reject on SPY) I cut calls and entered puts with volume confirming downside. The market is pretty easy to read. These moves are all based off of technicals so when you see a reject area + momentum loss + sellers stepping in - cut calls and switch to puts or cut calls and wait for confirmation for puts.

|

|

|

|

|

|

|

#24 |

|

Member

|

Not catching this until late, but VWAP has been rejected the last three times SPY touched it, except now it has blown past. Curious to see if SPY breaks 410 and then 411.5.

Not taking any trades, just watching previous rejections.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#25 |

|

Member

|

Based on 4130 open.

Top 4150, Bottom 4050, Key Level 4100.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

| Bookmarks |

|

|