|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#576 |

|

Member

|

|

|

|

|

|

|

#577 |

|

Member

|

|

|

|

|

|

|

#578 | |

|

Member

|

Quote:

When indices start trading at higher levels, go back to when we were last at that level even if it's a few years. Support/resistance still works. 4525 was resistance back in end of March/ early April 2022.

|

|

|

|

|

|

|

#579 | |

|

Member

|

Quote:

|

|

|

|

|

|

|

#580 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#581 | ||

|

Member

|

Quote:

Quote:

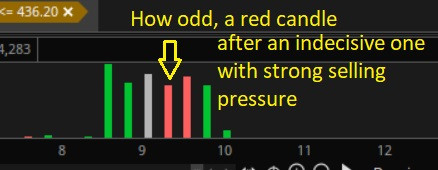

I'm all done for the day. Made $25.4k off 4525 rejects. Called it yesterday and gave y'all a heads up. 4 people caught it with me, hope a few more did as well. If you follow this thread and didn't take a trade, ask yourself why?  Education: My entries and exits - see where I enter and exit? AT levels, not in between or just when ever I feel like. That is how you keep your losses down. Be patient and wait for the trades to play out. I took some drawdown and went red on my 3rd entry, but volume was showing strong selling pressure so I held and the next candle after the indecisive one was.... you guess it, red. Why didn't I exit my 3rd trade @ 4520 like I did trades 1&2? Because we broke through it. When you break through a level you wait for a retest and see if we reject it - we did and continued down to the next level @ 4510 and bounced... funny how levels work. So don't let anyone tell you trading options is hard. You see right here in this thread how well the levels hit. Yes, you'll take L's, but if you trade levels and follow plans you will win way more than you lose - guaranteed.   ------------------------------------------------------------------------------------------------- Does everyone understand why the market is pumping the way it is? It's not because people think the economy is doing good. It's not because people think future earnings will be good. It's because the market was heavy in puts. Read back through the thread to see why that causes the market to pump. When the market has clear direction, this is they type of market that will make you "rich rich." I Sold puts against my shares in AAPL, MSFT, and AMD and bought them back this morning. The only thing outstanding is my TSLA $350 calls. The gain from all that is $230k. This is why it's important to know how the market works. That said, it's not rocket science and you don't need to be a stock market expert/guru to do it. Just simply learn to read charts and understand how the MM's/dealers make their money. When the market gets heavy in calls what will happen? I day trade to keep the money coming in, but I do have long/short positions and trade other tickers as well. ------------------------------------------------------------------------------------- Lastly, what a year!! Time for the yearly vacation with the family since the kids are out of school. Visiting Italy for 2 weeks. No "boss" to ask permission for vacation, no looking for someone to cover for me at work while I'm gone, and no answering "business calls or emails" while I'm away with the fam. This is why I trade and grind daily in the stock market, for financial freedom. Live life on MY terms and not on anyone else's schedule. Hope you all have a great day and as always, I want to see people win. Education always free here, I don't need your money for subscription services or teaching sessions or the "buy my training packs" bs. I know how to read the market and make money, so keep your $200+/mo and practice trading with it. If you take an L, learn from it and see why you lost and try again. .You'll lose more than that on the goofy subscription services. Stop making excuses and start creating some generational wealth

|

||

|

|

|

|

|

#582 | |

|

Member

|

Hope you grabbed some puts. I know you've been waiting on that level.

Quote:

|

|

|

|

|

|

|

#583 |

|

Member

|

Not in on spy yet. I took more Apple swing puts today though. Looking at the chart, I am shooting for a drop to $187. I do still want to get in on Spy though.

|

|

|

|

|

|

#584 |

|

Member

|

Took three trades, Initially 4420 puts (ATR band), just bounced around, cut and sold for $60 gain. Took 4420 Calls, which again bounced around but was also rejecting 4425, so I sold for $30 loss. Final trade was 4425 Puts (3 contracts), sold one when we broke 4420, sold the other at 4415, sold the third at 4410 (shortly after we bounced), $1,300.00 gain. First two trades were good, but that was keeping the losers small, especially the Call contracts. I also practicing letting the winners run, don't regret selling one after we broke 4420, but should have held the remaining two for 4410.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#585 | |

|

Member

|

Quote:

Had to grab one last trade when 4500 hit for a quick $4k gain. Took all day but was worth the wait. SPX - bounce 4500 for calls✅ 4500 contracts went from 4.90 > 9.00, for a $400 gain per contract. Levels are levels for a reason   ------------------------------------------------------------------------------------------------- Added: Education Even though we were selling and in a down trend, we had a high probability of a bounce as both SPY/SPX were hitting support at the same time. Always good to test calls/puts when you see confluence and exit @ resistance.

Last edited by Blazed; 07-14-2023 at 02:47 PM. |

|

|

|

|

|

|

#586 |

|

Member

Join Date: Nov 2010

Posts: 10,793

|

This is a foreign language to me, but damn, 25.4k in one day. Congratulations!

|

|

|

|

|

|

#587 |

|

Member

|

OPEX week. Trending up with low volume, killing premiums.

Lots of O/I on 4500 C expiring on 7/21, wouldn't be surprised if we get pinned around here the whole week.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#589 |

|

Member

|

7/17/23 – OPEX week, Market slow grind up on low volume killing premiums. Took four trades, all four trades were bad. Two trades in the afternoon were more based on emotion and wanting to get some of my money back. First trade of day I had SPX chart at 15m timeframe instead of 5m, kind of through of my entry when I thought SPX bounced Friday’s close of 4505, it was one point short and would not have been a good entry, when I entered the mark was 16.05 for 3 contracts, way too hight, 5m later I was down $1.7k, the 4th SPX 5m candle would have been the candle to enter as it rejected right at 4505, I don’t regret the entry level, just the execution was way bad, ended up selling because it was just chopping around, $3k loss. Could have held this one all day though as the slow grind up would have made this profitable. Instead of selling I should have just waited until SPX 5m candle broke below 4505 and closed, which it didn’t, however my entry was not right at 4505 based on my timeframe SPX error, so I was on the back foot from the start of this trade. The third trade I took 4515 Puts based on ATR and SPY volume, held for 30 minutes until SPX candle closed about ATR, so I exited, good thing as it just slowed grind up from there. Last two trades were just revenge/emotion trades. Tomorrow is a new day, you learn more from your losses than your wins.

Last OPEX on June 12 the first day was a slow grind up and then the second day saw an initial big move in the first 30 minutes, can’t go into a bias assuming the same will happen, but it’s worth noting. Market is still heavy in Puts. Tomorrow, 7/18, is retail sales numbers.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#590 |

|

Member

|

7/18/23 – OPEX week, data drop (US Retail, Retail minus auto, median) did not impact market. Market initially bounced 4513 ATR Band at the open, market slow grinded up ALL DAY as of 3:15 PM (EST). Took one trade, 4530 C (3 contracts) with intent of holding with expectation that the market was going to slow grind up all day. Held until 1:30 for $2,700 profit. SPX and SPY were in an uptrend all day, similar to day before (7/18), with low volume. Lots of O/I on 4550 Calls that expire on 7/21, curious if we range all day on 7/19 to stay within 4550. Tomorrow (7/19) is housing information.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#591 |

|

Member

|

No 0DTE SPX trades for me today, yesterday held for long grind up on low volume. Thinking that they close near or at 4550. Too choppy today, don't really feel like scalping SPX.

4550 has significant hedging.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#592 |

|

Member

Join Date: Aug 2022

Posts: 497

|

TSLA posting huge quarterly #’s and stock down $12 after hours. Seems to be the norm with the company, price drops after each earning period setting records and then rebound following day/weeks. Interesting….

Last edited by Jed Clampett; 07-20-2023 at 08:03 AM. |

|

|

|

|

|

#593 |

|

Member

|

No trades for me today or tomorrow, at work. I will follow. Yesterday was a range day, not sure if today will as well, but I will follow.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#594 |

|

Member

|

FOMC Week, MSFT/GOOGL earnings,

Top 4600 (4560 Resistance, Break Above 4580 Resistance), Bottom 4500 (4540 Support, Break Below 4525 Support), Key Level 4550 SPY Puts 454.1 - .5, 457.4 SPY Calls 449.3

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#595 |

|

Member

|

7/24 – FOMC Week, MSFT/GOOGL earnings, Consumer Confidence. Took 4550 Calls at break above 4550 and SPY confirming buyers, 4550 was my key level. Sold when SPX was breaking down and SPY was confirming sellers were stepping in. Got into 4550 Puts at break below 4550 and SPY confirming sellers. Sold when SPX broke and held above 4545 ATR band and SPY confirmed buyers. $480 gain on the day. Rest of day as of 2:05 has been chopping in 10 point range. Last month first day of FOMC week was choppy from the start, also within ten point range. Last FOMC week the Tuesday CPI data underwhelmed, market still went up, went up 20+ points within 15 minutes off the open. Consumer confidence tomorrow (7/25)

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#596 |

|

Member

|

Consumer confidence today.

Top - 4600 (4560 resistance)(4575 resistance) Bottom - 4500 (4540 support) Key - 4550 SPY Puts - 454.9 SPY Calls - 453.6 I won't be able to focus and trade for the first 30 minutes, hopefully I can at 10:00 when consumer confidence comes out.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#597 |

|

Member

|

Been chopping around all morning, barely in a 10 point range. 4565 had a lot of dealer exposure (Gamma I believe), so maybe we just chop around here all day until we get direction on rate hike?

Probably not taking any trades today at this rate.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#598 |

|

Member

|

Top 4600, Bottom 4520 (4560 support) (4550 support) (4540 support), Key 4580

SPY Puts 456.2, 457.3 SPY Calls 454.1, 452.1 Personal Income/Spending Data came in that people are spending more than they are making (go figure).

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#599 |

|

Member

|

7/28 – Took four trades today, all losers, total $550 loss. Mitigated my losses though. Took 4575 Puts twice and 4575 Calls twice. Both were based on closing above or below 4575, which was an ATR band, and also an area (4575-4580) of S/R. I would exit my position when SPX 5m closed at or below my 4575 position. Chopped around for most of the day, but eventually moved up to 4590, then stalled out and moved back down to 4575. Hanging around 4575 a lot today, which leads me to believe that there might have been some draw to it (GEX?). Need to learn more about GEX and dealer positioning as this really seems to help a lot in this market right now, and any advantage you can have helps.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#600 |

|

Member

|

Based on 4590 Open.

Top 4640 (4630 resistance > 4610 resistance), Bottom 4550 (4580 support > 4560 support), Key level 4600 SPY Puts 458.1, 459.3 SPY Calls 454.2, 452.1

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

| Bookmarks |

|

|