|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risquť images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#76 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#77 | |

|

Member

|

Quote:

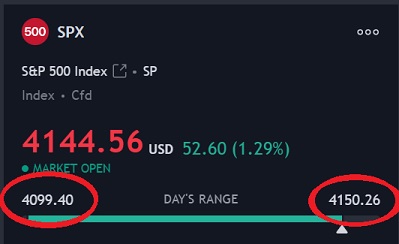

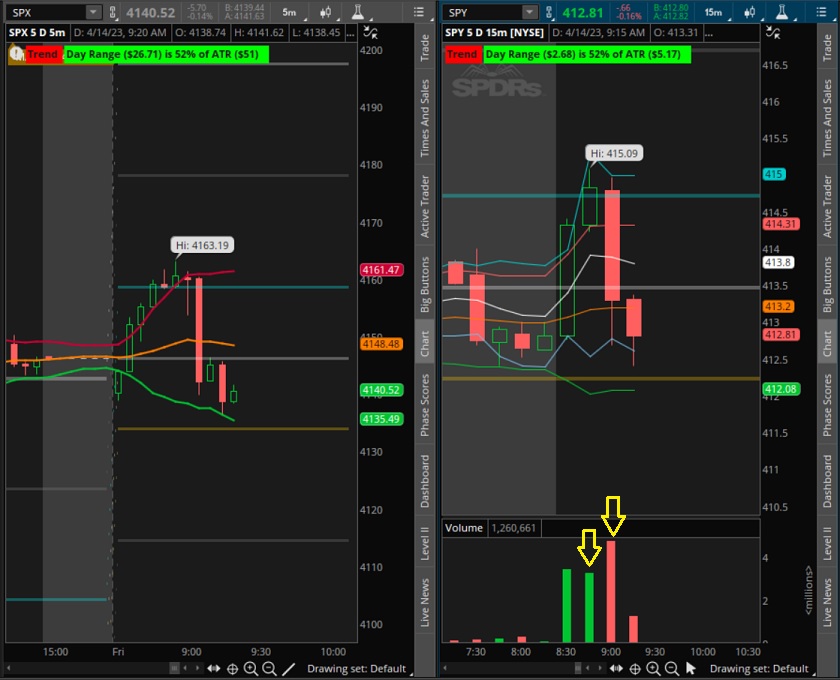

Trade recap: We went level to level. We had a gap up at open then a slow grind up the rest of the day - the up trend stayed in tact all day so there was no reason to be looking for puts. SPX: 4130 top (break above 4150 next resistance)✅ - we were able to finally break above 4130 and look where we rejected... levels don't lie. SPX: 4100 key level✅- bounced off 4100 6 times this morning before we rocketed up. If you got in @ 4100, you can hold your position all day and let it ride with the up trend. Just set a hard stop above break even in case it reverses. THESE are the kind of days I love to trade.

|

|

|

|

|

|

|

#78 |

|

Member

|

8:50, so its early, but I'll be away from my computer most all of the day, so I wanted to at least get what I was looking at.

SPY Reject 414.8, Bounce 409.3 Based on 4140 open as of 8:50 Range Top 4190 (O/I of 8k, ), Bottom 4100 (O/I of 5k for Calls, 6k for puts), Key level 4150 (based on 6k O/I for calls, need to break to continue uptrend) I realize the early posting could be impacted, but I wanted to at least get something down.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#79 | |

|

Member

|

Quote:

Looks good! ----------------------- Side note: The FED injected money back into Wall st for a reason, and the reason is obvious - they want to keep the market up. The same reason they say our inflation is 5% YOY - all smoke and mirrors. Lets see what the market gives us today. Trade smart and don't force trades. |

|

|

|

|

|

|

#80 | ||

|

Member

|

Quote:

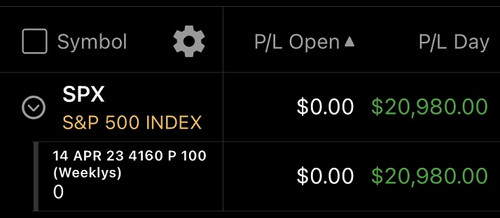

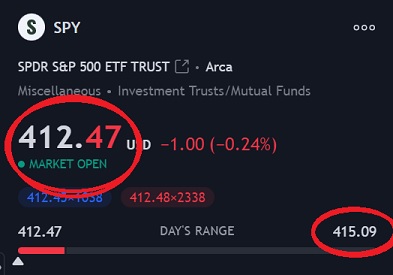

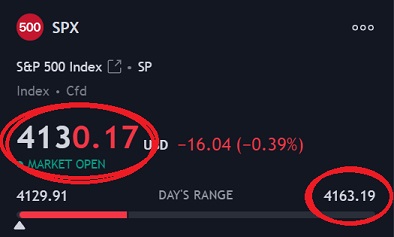

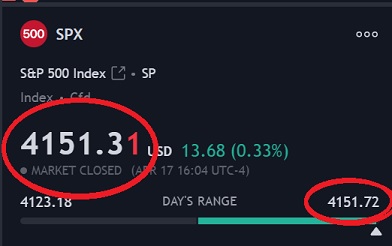

All done for the day, great way to end the week. If anyone took the 414.8 reject congrats, it paid. SPX 4160 contracts moved from $750 > $2,800 - a gain of $2,000 per contract. SPY Reject 414.8✅    Education: Volume confirmed that we were going to reject the 414.8 area as buying was slowing down on the 2nd 15 min candle - pretty straight forward. Watch volume and know where your reject areas are. Look where they brought us back to on this drop... 4130 which has been a key resistance level, now turned support. The quote below is from 4/12 - I was already watching for a 415 reject. Quote:

Hope everyone enjoys the rest of their day, a good weekend to get in some education. |

||

|

|

|

|

|

#81 |

|

Member

|

Based on 4137 open.

SPX bottom 4060 (O/I of 4k on Puts), Top 4150 (O/I 5k Calls), Key Level 4100 (O/I 1.9k Calls, 4k puts) SPY Reject 413.75 SPY Bounce 410.3 Blazed please comment as necessary. SPX was using 4150 as resistance as it has been in the past and we have not held since breaking it last Friday. I first thought 4150 would be key level and 4200 as top. Perhaps that was correct.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#82 |

|

Member

|

Earnings week kicks off and its also OPEX week. So it should be an exciting week overall.

SPX: 4200 top / 4100 bottom / 4150 key level If for some reason we get up to 4200 I will be taking puts. Also of note there's sell signals across the board. Watching: SPY reject 415 for puts SPY bounce 410 for calls Wait for confirmations, itís Monday donít rush into trades and only take A+ setups. |

|

|

|

|

|

#83 | |

|

Member

|

Quote:

Reason: 4150 becomes the key level because 4130 is now a support level. Break below 4130 > 4100. Break above 4150 > 4175 -4180 (weak) > 4200. |

|

|

|

|

|

|

#84 |

|

Member

|

Awesome. Yeah that all makes sense. I need to start narrowing down that reasoning based on previous support/resistance. That is good info, thanks.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#85 |

|

Member

|

My anticipation is to take Puts immediately if we reject 4150 as that is an ATR band in addition to key level. Been choppy so far this morning, lets see if start to push to 4150.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#86 | |

|

Member

|

Quote:

Since it is OPEX week, we will probably range and have bigger moves Thurs & Fri. The range is expected, as institutions take out big loans with high interest during OPEX to sell options against the holdings capturing premium burns so this range is exactly what they love. I do have an alert set for 4145 and will see how we look if we get there but probably won't take anything. |

|

|

|

|

|

|

#87 | |

|

Member

|

Quote:

Thanks.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#88 | ||

|

Member

|

Quote:

Last OPEX there was $1.4 trillion in options set to expire. I haven't looked yet this time, but scroll the options daily chains and look at the strikes with high OI. Based just on OI @ the 4200 strike, it looks like they want to hit that this week. Also notice where they closed us - right at the key level. They held us down all day and kept us within a range and waited to push us up to the key level during power hour. A lot of people who bought puts when we dropped below 4130 thinking it would act as resistance again got smoked. That's how they get cheap calls/puts. Quote:

|

||

|

|

|

|

|

#89 |

|

Member

|

Quote:

As always, thanks.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#90 |

|

Member

|

Based on a 4170 Open.

SPX Bottom 4100, Top 4200, Key Level 4175 (O/I 3K) SPY Reject 415 SPY Bounce 411

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#91 |

|

Member

|

SPX: 4200 top / 4120 bottom (break below > 4110 > 4100) / 4150 key level

4200 level is key on SPX. Watching: SPY reject 417.5-418 area for puts SPY 410 for a potential bounce. SPY uptrend entry 415 for calls - (Only with SPX confirmation) Could have another day where we range, so trade smart and don't force. |

|

|

|

|

|

#92 | |

|

Member

|

Quote:

I had 4150 as my key level being that broke above it, I selected 4175 as I thought that is a level we would need to break above in order to continue up, also had the highest O/I for Calls. I'm assuming though that it still should have been 4150 as this level was previous resistance and is now support?

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#93 | |

|

Member

|

Feb 2nd 1 hour chart.

Quote:

|

|

|

|

|

|

|

#94 |

|

Member

|

Currently in 4150 calls of 4150 bounce. Previous close and key level. Out of this trade, although volume showed sellers, I took the calls off Key level/Previous close. Volume should have been the confirmation, which it did not confirm, bad trade. Live and learn.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 04-18-2023 at 09:28 AM. |

|

|

|

|

|

#95 |

|

Member

|

Got it. Thanks.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#96 | |

|

Member

|

Quote:

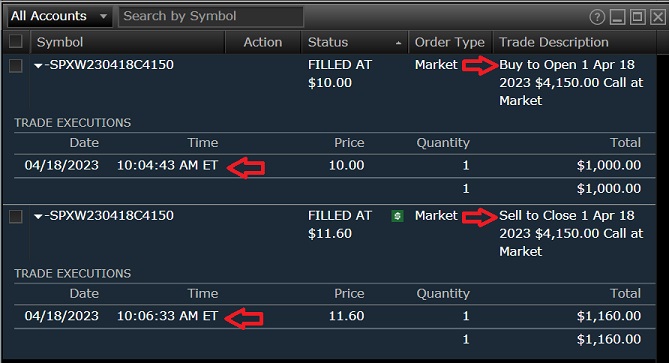

So the trade was good for a scalp. When we're in a down trend and volume is showing sellers are strong, you can still get a scalp off of a major support level as long as as the level isn't ignored completely. I took a call @ the touch of 4150 and scalped it for a $160 gain. Notice I was only in the position for about 2 mins but was able to get a 16% return on it - I'll take these returns all day.

|

|

|

|

|

|

|

#97 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#98 |

|

Member

|

Blazed is this type of market movement typical during OPEX week? Also can you elaborate on OPEX week, is it when different Options all expire at once? I vaguely remember this from the stock market thread. Sorry for having you explain it again.

Was 4150 treated just like 4130 yesterday? Hang around it and burn Theta for anyone taking 4150 puts?

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 04-18-2023 at 02:01 PM. |

|

|

|

|

|

#99 | ||

|

Member

|

Quote:

We also have the daily "OPEX's" that are referred to as 0dte's, don't confuse the 2, but when traders talk about OPEX they're referring to the monthly/quarterly. Here's the OPEX calendar - I think I linked in the other thread. Quote:

I also like these 2 sites - they just give you an overview of calls/puts. Put to Call ratio Max pain options |

||

|

|

|

|

|

#100 |

|

Member

|

SPX: 4175 top (break above 4180 > 4195 > 4200) / 4100 bottom / 4150 key level (4140.34 gap)

Watching: SPY 414 reject for puts SPY bounce 410 for calls TSLA on watch - Looking weak, still want to see that 120 area for heavy equity add. Earnings on deck. |

|

|

|

|

| Bookmarks |

|

|