|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#2076 |

|

Member

|

6/27/24 – Got into 547 Puts as a result of the big move up from SPX and both SPX and SPY being overbought, with SPX rejecting .14 points from Blazes 547. Waited for SPX to break below ATR AND RETEST THE ATR ON THE 1M, which it did, so I entered. So many times in the past I don’t wait for retest as I don’t want to miss the trade, then I get the retest, which cuts into my premium because I filled at a higher premium, then this impacts me taking profits sooner because of the drawdown from my bad entry. Held when SPX was breaking above ATR and rejecting earlier HOD of 5489.89. Cut two contracts at 5480, when it bounced prior 5480 bounce, should not have cut, should have just waited for previous close. Did not cut at previous close as SPX blew past it, cut two contract when SPX and SPY bounced middle BB. Cut last two contract when SPX closed above and bounced last close. $230 profit.

EDIT: Just realized the bounce where I made my second cut was opening print. Idiot. That would have been good to notice.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 06-27-2024 at 12:29 PM. |

|

|

|

|

|

#2077 | |

|

Member

|

Quote:

Another stress free trade, as a plan was in place and followed. Awesome to see it.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2078 |

|

Member

|

Going to wait for data. We know why the market pushed up last night, see what data does.

Watching solid areas SPX: reject area 5500 > 5505 (Need strong confirmation) bounce @ 5450. Mainly watching for bounces. That could change though based on data. Watching: SPY: 547 bounce BABA: same as yesterday. NVDA: no rush on equity. Playing calls/puts until it gets to my add spot. TDOC: looking good this morning. Holding above the 8 & 5, should start to push now.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#2079 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Consumer sentiment @ 10 (waiting to trade until after)

SPX top 5550, key level 5500, bottom 5450 Watching SPY 547 area closely (couldn't crack it yesterday, but looking like resistance turned support based on premarket, so we'll see if it holds). If it holds, watching 548.25 - 548.50 as next area for a reject. |

|

|

|

|

|

#2080 |

|

Member

|

Took a quick 547 bounce light size - all out here before data.

Quick little $820 off that bounce. Now waiting for data.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#2081 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

No trades yet, which is fine by me lol. Rather not take a trade than jump in just for the sake of it and try to call the top. ATH's are a tricky thing. Bouncing around SPY 550 and staying below 5524 ATR which will be interesting to see what we do here, but I'm just setting alerts for 5550 for a reject and 5500 for a potential bounce. If I miss anything else, I miss it. Next week will present new opportunities.

|

|

|

|

|

|

#2082 | |

|

Member

|

Missed the move up. I was in calls too lol.

Took 2 -SPY250117P550 @ 1700 Calling it a day here. -------------------------- Quote:

Will sell puts after entry like last time.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2083 | ||

|

Member

|

Quote:

Quote:

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

||

|

|

|

|

|

#2084 | |

|

Member

|

Quote:

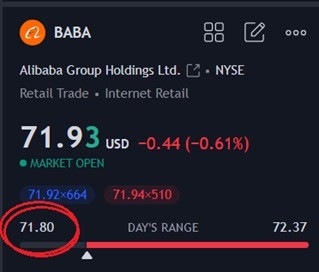

Blaze you mind if I tag onto this? I was going to buy two call options with a 70 strike, not sure if I'll do 1 or 2 months out. Just want to get used to swing options and using the EMA/SMA. This would be a live trade though, not paper. Looking at $70 entry. Do you wait until the entry closes at or below $70 on the daily before entering or do you enter at $70 at the close of another smaller timeframe?

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#2085 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Embarrassingly bad risk management and fill today. If there's no clear exit plan established to the downside, then I should never enter a trade. Gotta review heavily this weekend, continue to work on shaking out the bad habits, and start fresh Monday with a clear head. I know it's good for me in the long run that I wasn't actually up today though- there's nothing much more dangerous than getting the right result from the wrong action.

I didn't have a clear exit point if the trade went against me today, which meant I kept moving my mental stop to fit the trading position I was in and not the information the market provided; a sure-fire way to risk more than you stand to gain and turn what should be stress-free trading into nothing but stress. What/when I traded: 2 SPY 549C contracts. I entered @ 10:00:02. Reason for entering trade: I waited to see where the 9:45 SPY candle closed to get an indication on if a trade should be taken (it was very close in volume to the 9:30 SPY candle so I didn't want to enter early). I was looking for a bounce off of 5500 (I entered around 5506 as soon as the 9:45 SPY candle closed slightly lower though). My thought process for entering was that we were around a whole psych # and seller's were continuously slowing on the 9:15, 9:30, and 9:45 candles. "Exit plan, if you can call it that today": I wanted to give the trade room, but with the bad fill at 5506 and thinking that we were rejecting 5500 early based on lower volume, it also kind of threw me off on where to cut. Originally, I was thinking at a break below of 5500, then the 5493 ATR (13 points lower than where I entered). I couldn't make up my mind and it was a series of mistakes made today. I ended up selling around previous close for a $200 loss. |

|

|

|

|

|

#2086 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#2087 | |

|

Member

|

Quote:

I'll enter when it gets closer to the 70.4 > 69.4 area It could also bounce here as 72 is a level on the monthly. If it loses 72 then > 70/69 area is next. I'm thinking next week being a short week I'll get 70. If it doesn't and I miss it I already have shares so it's not a huge deal, but would like to add a couple thousand more.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2088 | ||

|

Member

|

Quote:

Entry @ 5500 (touch of level) w/ a stop @ 5495 or 5493 ATR depending on size & risk tolerance. Quote:

Journal it and next time unplug your mouse (if that's what you use) or sit on your hands until the level hits lol. Yesterday was a perfect stress free trade, waited for the level to hit and executed.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

||

|

|

|

|

|

#2089 | |

|

Member

|

Quote:

Also correct on the 450 being A+. I took two Jan 17th 25 puts up there.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2090 | |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Quote:

|

|

|

|

|

|

|

#2091 | |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Quote:

Journaling it and reviewing this week's trades during the weekend. $200 tuition is not bad either. Gotta pay my dues haha. Back at it Monday! |

|

|

|

|

|

|

#2092 |

|

Member

|

Data today. Short week so not in a hurry to take anything off the open unless 5450 hits.

SPX: 5450 main watch Watching: NKE: above 76.2 looks decent. (Thanks lane for pointing out Nike as it’s not a stock I normally watch) Going to see how the market moves going into the holiday

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#2093 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

PMI @ 9:45

Construction spending & ISM manufacturing @ 10:00 SPX top 5500, key level 5450, bottom 5400 Watching SPY 547 area for a reject with strong indication (held up pretty well Friday too, but resistance turned support and then back to resistance), or if we get there, 550 for a reject. May just monitor today though with the upcoming holiday; not eager to get in anything but can still learn a few things today! |

|

|

|

|

|

#2094 | ||

|

Member

|

Quote:

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

||

|

|

|

|

|

#2095 | |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Quote:

|

|

|

|

|

|

|

#2096 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

5450 looked to be the play today after data with a quick move up to previous close. Oversold on SPX/SPY and whole psych # + ATR. I would have waited for the ATR to hit today with a stop @ break below 5445.

|

|

|

|

|

|

#2097 | ||

|

Member

|

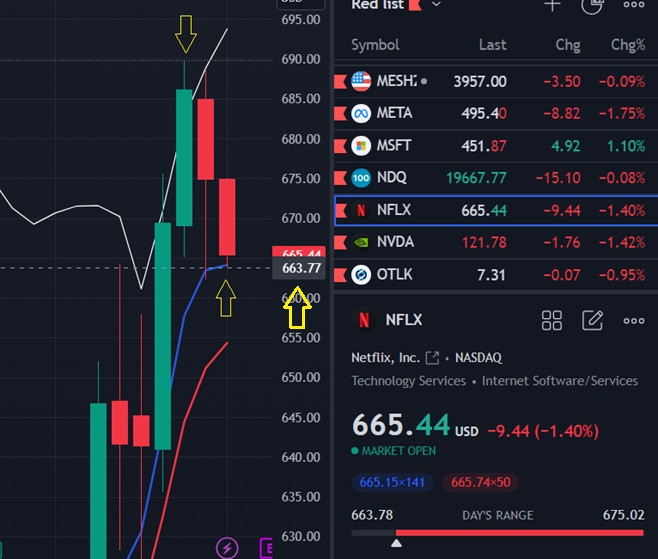

Quote:

Quote:

700 - 701 would be the reject area to watch - touched 690 pre-market on the 20th (pushed up off data that morning). Data push screwed up the 700 area reject as it pushed it into overbought too fast. Then 663 (8ema)✅- after the push off data pushed it into over bought area, technicals played out. NFLX @ 663 as expected. Easy predictable trade.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

||

|

|

|

|

|

#2098 |

|

Member

|

Took some calls here. Taking them back to VWAP on SPY.

Stop 5 pts below 5450

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#2099 | |

|

Member

|

Quote:

Gains from this trade - $5.2k.  Going to call it a day here. Powell speaking tomorrow in Portugal, don't know what it's about so might not affect the market. Wednesday ADP / Jobs / Services PMI. Back at it tomorrow.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2100 |

|

Member

|

Powell speaks today, would be nice to get a move going into the holiday.

SPX: 5450 main watch. No rush today. Tomorrow is the big day with data. Today could be too with Powell, we’ll see.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

| Bookmarks |

|

|