|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#2126 | |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Quote:

|

|

|

|

|

|

|

#2127 | |

|

Member

|

Quote:

Be patient and let volume confirm, see how close next level/ATR is, or wait for it to turn into an intraday s/r level. These types of areas are easy to get smoked on.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2128 |

|

Member

|

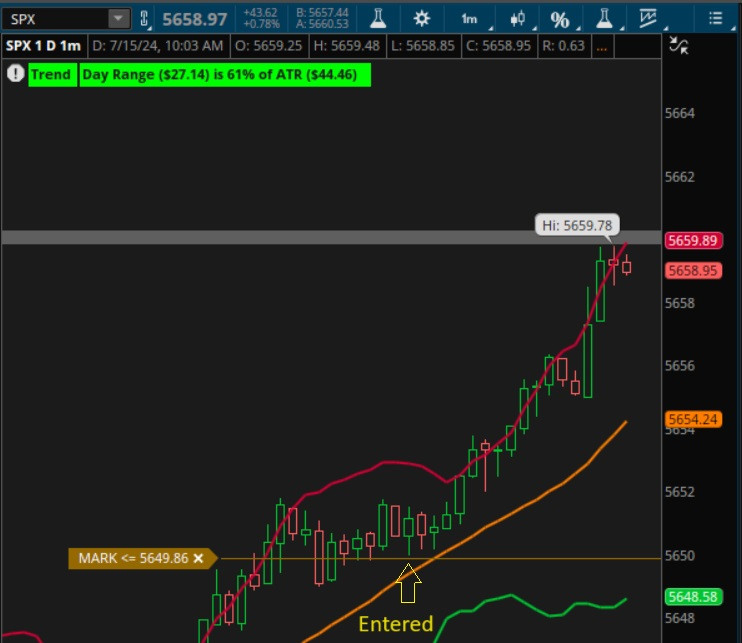

Be patient here @ 5650 - break and retest either way

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#2129 |

|

Member

|

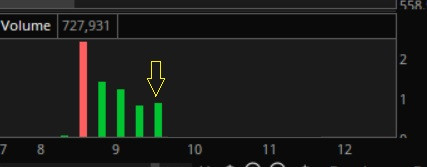

Waiting on this next volume bar to close in 4 mins

Also @ NQ resistance. So we'll see. Powell in an hour

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#2130 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Dang, I was already in on 3 SPY put contracts a little after 10:30 est based on getting to the key level, the lowering buying on the 9:45 - 10:15 candles, SPY closing below the 562.80 ATR multiple times, and being outside SPY bollinger. I got out when the 10:55 SPX 5 minute candle closed above 5655 for a $87 loss. Seemed like a great set up with multiple confirmations.

|

|

|

|

|

|

#2131 | |

|

Member

|

Quote:

Be patient here @ 5650 - break and retest either way✅- patience paid. Waiting on this next volume bar to close in 4 mins✅- closed strong green so no puts. 9:45 volume closed strong and tend is up.  Entered calls off the 5650 retest. Trimmed @ 5660 ATR and letting the runners run. Next trim @ 5670 or stop out @ break below 5655  The break and retest is the easiest way to enter a trade off volume. Just gotta be patient and wait for the retest after the bar closes.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2132 | |

|

Member

|

Quote:

Got stopped out on that drop. Gains from this trade $6.7k Now just waiting for Powell

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2133 | |

|

Member

|

Quote:

The 9:30 volume was strong, 9:45 volume was strong (both had low volume) which is why I said be patient @ the key level to see which direction they wanted to push it. Also why I waited for a break and retest of key level. All good though, it's a process and these days are great to have for educational purposes going forward.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2134 | |

|

Member

|

Quote:

Nice sell off from HOD. I didn't catch puts, but beautiful drop. Only a matter of time before the big flush. Can't wait.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2135 |

|

Member

|

Went light on some calls.

Saw we were holding the 5626 ATR and buyers stepped in. All out @ 5643 ATR. Level to level. Gains for today $8.4k. Calling it a day here. Retail sales & home builder confidence tomorrow. Back at it tomorrow.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#2136 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Home builder confidence index @ 10 (no trades before then for me)

SPX top 5700, key level 5650, bottom 5600 (might also be the same as yesterday though) Not seeing anything on SPY I like at the moment. META: Watching for a possible 511 area reject MSFT: Watching for a possible 457 area reject Also, BRK.B is overbought on the daily/weekly |

|

|

|

|

|

#2137 |

|

Member

|

Not liking the market this morning.

Took TSLA puts. Gains from TSLA: $2.2k Took SPX calls. Took an L. held too long, didn't trim, went against trend/volume: (-$650) Gains for day: $1.5k No more trades unless range breaks (5650 key level & 5631 ATR) or one of those levels is hit

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#2138 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

What/when I traded: 3 SPY 564P contracts @ 10:10 (est) based on the 10:09 candle retesting.

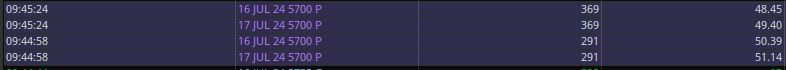

Reason for entering trade: SPX had broken and closed below the 5642 ATR on the 1 minute candle and had retested @ 10:09 and closed below the 5642 ATR as well. Additionally, we were in a down trend at the time and SPY 15 minute candle appeared to be closing under the 562 ATR. Exit plan: Cut if SPX 5 minute candle closes above the 5642 ATR. If not, trim/sell at the 5631 SPX ATR. Where I sold: I ended up selling when I switched back to the 5 minute SPX chart and the candle closed above the ATR on the 10:15 SPX candle. Total loss on that trade $60. Total profit for the day $50 (bought 4 Berk B puts and profited $110) I was also watching for big orders blocks around the data drop and these ones stuck out to me, which made me think we would head lower.

|

|

|

|

|

|

#2139 | |

|

Member

|

Quote:

Gains from this trade $4.8k  Break above & retest. All out @ 5660 ATR - level to level. Full exit, no runners as I'm not liking how the market is moving. So took my money and ran. With screen time you will start to recognize these types of plays and patterns. Once you master that, that's when the real money starts coming in.  VIX expiration tomorrow, NFLX Thursday, and OPEX Friday.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2140 | |

|

Member

|

Quote:

Good call on BRK too, I started watching it but got focused on TSLA.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2141 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

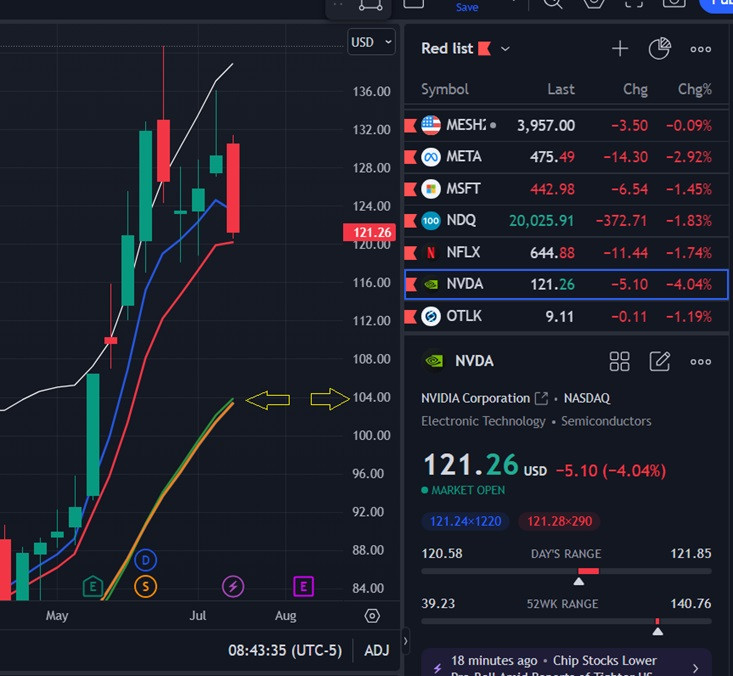

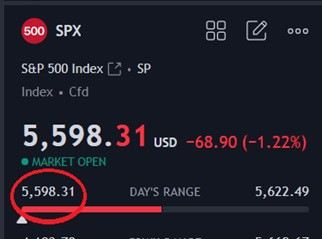

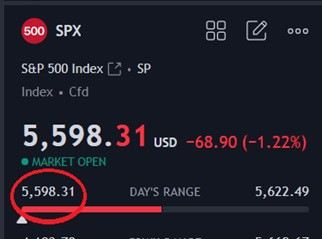

SPX top 5650, key level 5600, bottom 5550

NVDA: Watching for a possible 117.50-118 area bounce MSFT: Watching for a possible 441 area bounce |

|

|

|

|

|

#2142 | |

|

Member

|

Quote:

gap @ 5639

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2143 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

|

|

|

|

|

|

#2144 | |

|

Member

|

Quote:

Took four SPY 550 P 17JAN25 Expiration, similar to Blaze, but with the same mentality as when I took the 550 C with 28JUN24 expiration, just can't imagine the market going up for 6 more months. Money I can lose, not worried about it. Going to follow key S/R areas and trim as needed, would like to keep at least two runners.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#2145 | |

|

Member

|

Quote:

NVDA should go back and touch 100-105 area soon (obviously not today). I will add full position there and hedge my position.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2146 | |

|

Member

|

Quote:

Forgot this. Looking for a mean (20dayma) revision after we lose 120 Add spot. This is why I don't FOMO into trades. I have my add spots and wait for them to hit. If I miss it, I miss it. On to the next trade.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 Last edited by Blazed; 07-17-2024 at 08:49 AM. |

|

|

|

|

|

|

#2147 |

|

Member

|

In puts off the 5622 ATR. Trimmed @ 5610 > 5600 next. Looking to lose 5600 with runners

Watch 5600. Hasn't been a super solid level be patient.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#2148 | |

|

Member

|

Quote:

ATR's ftw. Locked in gains from this trade $7.3k Entered, trimmed @ 5610 > trimmed @ 5598 > still have 2 runners. Will cut above 5612.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2149 | |

|

Member

|

Quote:

ATR's ftw. Locked in gains from this trade $7.3k Entered, trimmed @ 5610 > trimmed @ 5598 > still have 2 runners. Will cut above 5612. (cut while typing this up) all out.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2150 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Didn't take these, but it'll help build confidence with charting. MSFT bounced exactly @ 441 in the morning. I was watching MSFT on the screen, SPX/SPY and I had TV open looking at NVDA. I should know better lol. I still think I would have missed the SPX move. Though, volume clearly showed that buyers were slowing before the candle close. I just thought we would have chopped around more this morning. Another opportunity to look over this weekend and to focus on more screen time.

Last edited by lane121; 07-17-2024 at 09:46 AM. |

|

|

|

|

| Bookmarks |

|

|