|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#201 | |||

|

Member

|

Quote:

Quote:

Quote:

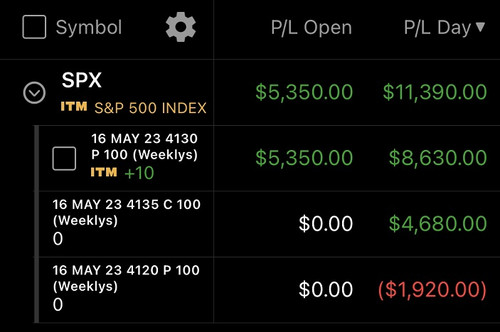

Also why I like to trade SPX, the contracts move great especially in the mornings. This is what momentum trading is. This is also why my gains average between $5k - $10k+ per day when I trade because I'm patient and follow my plan. I always look at R multiple before taking a trade and trade 10 to 20 contracts at a time depending on if I enter early or wait for a level to hit. Trading gives you true financial freedom when done right and you put in the work. Back at it tomorrow! |

|||

|

|

|

|

|

#202 |

|

Member

|

Based on 4124 Open.

Bottom 4100 (below 4080), Top 4185 (Resistance 4175), Key Level 4130 (watching 4135 as previous close and also watching 4125 as SPX rejected early in morning then bounced multiple times rest of day when it broke through. SPY Puts 412.6 - .8, 413.4 SPY Calls 410.8 Market sentiment regarding news seems to be not good, however this good just be fearmongering that the US will default. I am not knowledgeable to know the intricacies of this stuff, but I imagine retail traders will be affected by this and MM's will look to take advantage of it. We'll see.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#203 |

|

Member

|

Remember if the market stays in a range don't force anything. You only need 1 good A+ trade a day to get you where you need to be.

SPX: 4180 top (4150/4165.12 (gap) resistance) / 4100 bottom (4090 support) / 4130 key level Watching: SPY reject 414.2 for puts SPY bounce 410 for calls (409/408.9 would be a better entry for small accounts) Also worth watching TSLA - selling off right now. Still looking for 120 area (obviously not today but it's still on watch) on TSLA for a full equity add. |

|

|

|

|

|

#204 |

|

Member

|

Jumped in 4125 Calls when third SPX 5m candle bounced it, 4125 was previous support resistance plus ATR band, cut this position for $40 gain when two SPX 5m candles rejected 4135 (or close enough for my liking; 4135.9 was yesterdays close), so jumped into 4130 puts, cut position for $630 gain when SPY bounced my 410.8 candle.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 05-16-2023 at 09:29 AM. |

|

|

|

|

|

#205 | |

|

Member

|

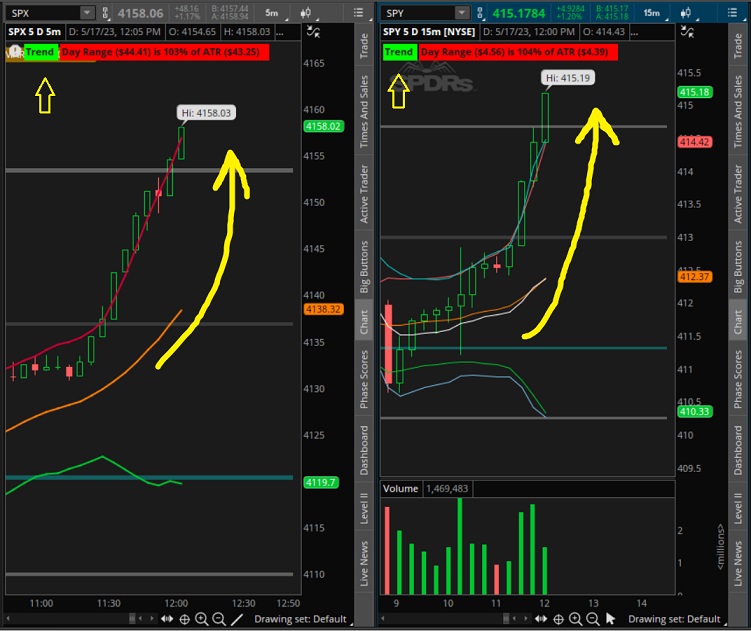

Quick education on supertrends and how you can play them.

SPY 15 min we hit the supertrend (red line) and rejected hard.  We bounced at the SPY 1 hour supertrend (green line). These are super easy plays to see (as you can see you don't need a messy chart with 40 indicators - just supertrends) and why you need to look at multiple time frames to see the full picture. Quote:

Trade recap: 4130 reject was the play today. All done for the day. First trade I took was 4120 puts because it looked like we were going to break 4120 and head down. Instead we bounced so I took an L on this trade. Second trade I took was the bounce at 4121 - I took the 4135 calls because I was expecting a 4130 touch and reject based on levels. Third trade I took was puts at the 4130 reject - trimmed some of my position but still have runners because trend is down and we're losing momentum.  Hope everyone enjoys the rest of their day, congrats if you took any trades. |

|

|

|

|

|

|

#207 |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#209 | |

|

Member

|

Quote:

I grabbed some AMD May 26th 105 puts here. SL set at 50%. Reason for the trade, way overbought on every time frame. Price target 99 > 97. |

|

|

|

|

|

|

#210 | |

|

Member

|

Quote:

|

|

|

|

|

|

|

#211 |

|

Member

|

Prime example of OPEX games, MMs getting puts and calls out the money which is why I got 2 weeks out. If AMD can break 105.3 this week with strength it has room to 108ish area. Right now it lost momentum and just pumping off low volume. Finally getting some selling volume coming in.

Added: Liquidity grab from the puts this morning. This is what has been going on for the past couple of weeks. Last edited by Blazed; 05-16-2023 at 11:46 AM. |

|

|

|

|

|

#213 | |

|

Member

|

There we go AMD, finally retracing. Put volume picking up.

Added: Quote:

Someone else on here played breakouts in 20/21, I can't remember the username though? Last edited by Blazed; 05-16-2023 at 12:27 PM. |

|

|

|

|

|

|

#214 | |

|

Member

|

Quote:

I'm staying in these AMD puts (currently down $12/con), but not a good idea to swing anything you can't afford to lose. As you've seen so far, today is a "wreck your account" day. VIX tomorrow and everything else Friday. ------------------------------------------------------------------------------------- What I'm watching on AMD - retraced and broke below VWAP on the 15 min. On the 4 hour I want to see it break below the 8ema and test the mean (orange line) at 97ish.

Last edited by Blazed; 05-16-2023 at 02:55 PM. Reason: Added AMD chart |

|

|

|

|

|

|

#215 |

|

Member

|

Based on 4127 Open.

Bottom 4100 (Below 4080 Support), Top 4180 (4170 Resistance < 4175 Resistance), Key Level 4130 (4150 resistance) SPY Puts 412.6, 413 SPY Calls 411.1, 410.2

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#216 |

|

Member

|

There's no change in levels from yesterday. Trading light today unless we get a direction.

SPX - 4180 top (4150/4165.12 (gap) resistance) / 4100 bottom (4090 support) / 4130 key level Watching: SPY - 415 is key area to break above for calls SPY - 409 bounce for calls, break below for puts Approaching reject from yesterday 412.5-413 - higher risk. |

|

|

|

|

|

#218 |

|

Member

|

Are you referencing SPX puts, or something else? Curious as to where you checked/monitored this specifically. Thanks.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#221 |

|

Member

|

Took 4130 puts at open of of third SPX 5m candle, rejected 4130 two times. Held until break below SPX ATR band, was going to hold until 4110 which was yesterdays close plus ATR band, but took $620 profit, I want to be more realistic as when I trade real money, I want to be taking $500-$600 profits and not hold for hope i can get more and get greedy. Again, with 10 contracts, that's a nice $6200.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#222 | |||

|

Member

|

Quote:

Quote:

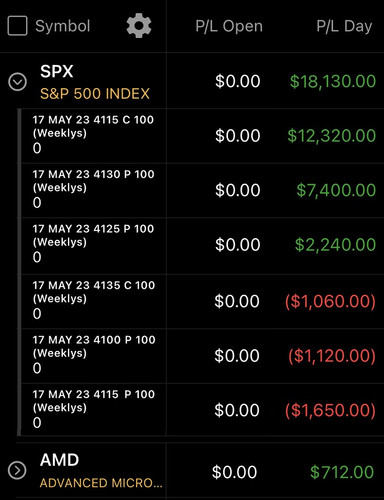

All out of everything here including AMD position. SPX 4130 key level✅ Winning trades: First trade I took was 4130 puts off the open for a $7k gain. Reason, SPY showed huge selling pressure off the open and 4130 was key reject level as we have been hanging around it for a few weeks now. Second trade I took was the 4115 bounce for a $12k gain - went heavier on this trade. Reason, SPX bounced it then came back and rested. On the retest SPX showed increased buying while the selling decreased. Third trade I took, I added some 4125 puts because I went light on 4130's. I added to my winning position because I saw we had room down with confirmations. Losing trades: First loser, since it's OPEX I took some 4135 calls for a $1k loss to hedge my 4130 puts just incase we broke and headed up. Cut position when downside confirmed. Second loser, took some 4100 puts to hedge my 4115 calls incase we didn't bounce. It's OPEX, so hedging was a safe move today even though resulted in a $1k loss. Third loser, took 4115 puts as a hedge against my 4115 calls. Took a $1k loss, cut my position when upside confirmed. AMD - exited puts for a $700 gain - don't let a green trade go red. Keep the losers small, you don't have to win every single trade to be a successful trader. Granted, I did take trades today that I wouldn't normally take (hedging), but I still used risk management and cut my position when I saw or thought I was wrong.  Quote:

|

|||

|

|

|

|

|

#223 | ||

|

Member

|

Quote:

Quote:

|

||

|

|

|

|

|

#224 | ||

|

Member

|

Quote:

Quote:

Education: This game of trading is deep and there's a huge learning curve to it. But that's what makes it so fun, there's so many layers to learn and there's no shortcuts to learning them no matter how many subscriptions you buy or courses you buy - you have to put in the work. Once you get your foundation, then the building you can do off it is endless. Funny how people will go to college for 4, 5, 8 years and get 6 figures into debt, but won't take a year or 2 to learn a skill that will give you financial freedom. Hope everyone enjoys the rest of their day. |

||

|

|

|

|

|

#225 |

|

Member

|

I won't be identifying any levels today, today is a do my actual work day. I will be checking in based on what Blazed posts. Curious to see how the day unfolds based on yesterdays bear trap (new scenario learned by me).

Blazed is what occured yesterday a specific OPEX occurence or could it possibly be a scenario that plays out at any key event? As always, thank you for the insight.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

| Bookmarks |

|

|