|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#2251 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

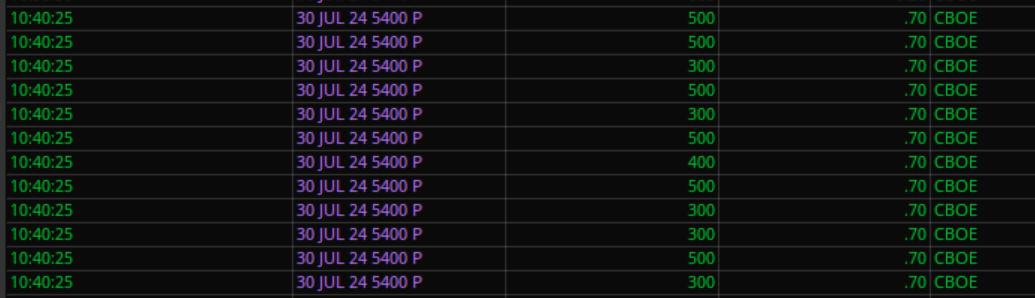

Big OTM puts order block

|

|

|

|

|

|

#2252 |

|

Member

|

That was a fast drop. No calls @ 5450 as it blew right though it.

Waiting on reclaim then retest. Or 5416 Missed put entry.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#2253 |

|

Member

|

I looked away for a five seconds, BOOM, right past 5450.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#2254 |

|

Member

|

Was there anything you considered for that Put Entry? the 1m reject at 10:07 was the only entry I considered, however buying volume was low, don't recall the trend at that time, couldn't remember if it was green or red. Wasn't any other real big indicator. Unless I missed one.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#2255 | ||

|

Member

|

Quote:

Quote:

Remember when NVDA was 140 lol? NVDA should go back and touch 100-105 area✅- filled 2k shares @ my area. This is why you don't FOMO into trades. Technicals will play out.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

||

|

|

|

|

|

#2256 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

|

|

|

|

|

|

#2257 | |

|

Member

|

Quote:

Looks like they bounced early, but the next level I had was 5416 (ATR @ 5426 too) but liked 5416 better.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2258 |

|

Member

|

Awesome. See why we wait on levels even when adding equity?

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#2259 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

|

|

|

|

|

|

#2260 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

This was the only thing I saw indicating a potential move lower, but they pumped it up to the ATR resistance first before dumping

|

|

|

|

|

|

#2261 | |

|

Member

|

Quote:

Was hoping they would take it down to 5416.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2262 | |

|

Member

|

Quote:

Flow took it down to 5400 then bounced

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2263 | |

|

Member

|

Quote:

Left 2 runners for SPY VWAP @ 543 for full exit

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2264 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

ATR's for the win again lol. I was taking a break for lunch and wasn't at the computer so I missed it, but definitely one I'd take every time. Will probably monitor and watch closely though tomorrow with FOMC.

|

|

|

|

|

|

#2265 | |

|

Member

|

Quote:

Gains from this trade $9.3k Easy stress free trading.  FOMC tomorrow. MSFT & AMD after bell Was going to play MSFT puts but after the sell off I'll see where MSFT is during power hour.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2266 | |

|

Member

|

Quote:

Tomorrow should be fun w/ earnings + FOMC.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2267 | |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

Blazed,

Quote:

And, if they go down in price then you keep the premium on a stock you were planning to hold long term anyway. Or if they go down, then you could buy back the calls cheaper, thereby basically reducing your cost basis on the stock from the difference between the premium you sold for and the premium you bought back for? I'm just trying to wrap my head around it, because it seems like a win-win so I feel like I must be missing something lol. Though, I know you can't sell it otherwise until that expiration expires. Thank you! |

|

|

|

|

|

|

#2268 | ||

|

Member

|

Right, NVDA will be a long term hold - years.

Quote:

Another way you can hedge, is sell covered calls and buy puts at ATH's Example: You bought NVDA @ 105 and it goes up to all time highs @ 180. Sell some 180 or 200 calls. Let the calls expire or buy back for less (keep that premium) and sell the puts when they increase in price (keep that premium). Quote:

Correct. I do this when shares I have hit record highs/lows. Goal here is to get the cost of the stock down as close to free as possible. When I sell covered calls I always go a year out (doesn't mean you have to hold them that long), but I intend on them expiring or going almost worthless so I can buy them back. If you look back though the thread I did that with BABA & TSLA and a few others. Sold some covered calls a year out for about $900/call and bought them back for around $300/call - kept $600 profit per call. The equity I still have in BABA, my avg is around $43/share now. That said I don't do the weekly or monthly expirations because anything can happen news/data wise and go against my position. So I always go at least a year or sometimes 2 years out if they have strikes available. I do that for time and to collect a higher premium since it's a long term hold. And just like when you buy SPY/SPX options, you want to sell covered calls @ key areas/levels too.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

||

|

|

|

|

|

#2269 | |

|

Member

|

Quote:

No edge so not playing earnings. Was going to play puts before the sell off this morning.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2270 | |

|

Member

|

Quote:

Down 30 points. Oh well.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

|

#2271 |

|

Member

|

Sorry for disappearing gents, had to get stuff done towards end of the day.

7/30/24 – Missed an entry at 10:07 when SPX reject ATR along with SPY rejecting the same ATR/Upper BB. The play could have been since the market dropped on data, was looking for a bounce of previous close but never hit, when it rejected the ATR that could have been the entry, however SPY volume was still showing buyers as the first SPY candle closed Green and was higher than the next SPY candle (red). Wasn’t looking at Puts as the SPY candles were closing red and much lower than the opening green candle. SPX was pushing down on low volume so wasn’t looking at Puts. Didn’t catch the major drop down later in the morning as there was no entry point (no break below and retest). Waited for 5400 as it was near ATR and market had moved passed implied bottom so likelihood of bounce was high. Took 3 contracts, cut one at middle BB on SPX, cut second two at ATR (should have cut one and left runner). Reason I cut the second was becaue of SPY volume and it appeared SPX might be losing momentum. $245 profit.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#2272 |

|

Member

Join Date: Jul 2011

Posts: 1,760

|

MSFT watching for a potential 417.50 reject

*Looks like it jumped above this area premarket so no longer looking for a reject here* Last edited by lane121; 07-31-2024 at 08:28 AM. |

|

|

|

|

|

#2273 |

|

Member

|

FOMC today so no levels.

You know what to do on FOMC day. SPX 5500/5492 is all I'm watching pre FOMC.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

#2274 |

|

Member

|

FOMC today. Will wait 30 minutes and if it chops/no setup, I'll wait until FOMC, IF I TRADE FOMC IT WILL BE ONE CONTRACT, PREPARED TO LOSE IT ALL (TRADING SPY). Need to trade this day for real at some point.

Top 5550, Key Level 5500, Bottom 5450, Gap 5489.46 Plus ATR's. SPY Reject 550.44 - 551 SPY Bounce - Don't really have a good bounce area I like. 542 would be the only one, but not using that as a trade entry point.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#2275 | |

|

Member

|

Quote:

Took a light entry @ 5500. Trimmed @ 5512. Left 1 runner for possible run up into FOMC. Runner stop set @ 5500 Will wait for FOMC until next trade.

__________________

Everyday you wake up you’re guaranteed a chance and a choice. What you do with them is up to you. Make it a great day, or not. The choice is yours 🫡 |

|

|

|

|

|

| Bookmarks |

|

|