|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#401 | |

|

Member

|

Quote:

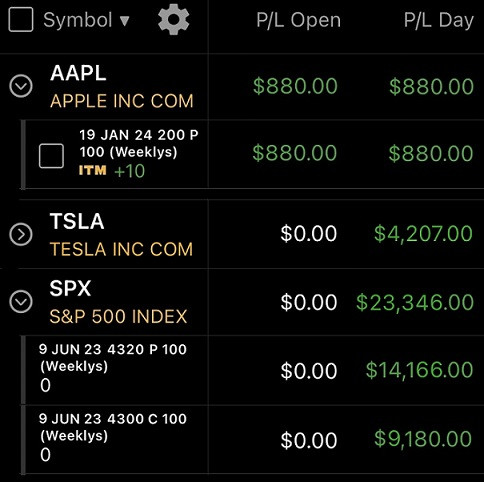

Trade recap: Tried to post what I was doing as I was doing it. When I exited calls, when I entered/exited puts, and what I was watching for... so hopefully that helped out a little more. APPL puts still look good, if you check out the daily and weekly we have plenty of room down. Over the next 6 months want to see AAPL around 167 or lower. Hope everyone enjoys the weekend. Good time to get in screen time and learning. Back at it Monday.

|

|

|

|

|

|

|

#402 | |

|

Member

|

Quote:

Next week will be very interesting. A lot of important data dropping + OPEX, should be a fun week to see what direction they want to take us. |

|

|

|

|

|

|

#403 |

|

Member

|

OPEX this week, FOMC rate decision Wednesday (Meeting starts Tuesday), CPI Tuesday

Bottom 4270 (4280 support), Top 4350 (4330 resistance), Key Level 4300

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#404 |

|

Member

|

Keep in mind we have a huge week of data, CPI, PPI, and FOMC and OPEX Friday. I am going to be extremely patient today and wait for the right opportunity - in fact I might not even trade today, we'll see. But tomorrow is a big day and the Super Bowl is on Wednesday.

Until we show signs of weakness I won't be looking for puts. Just watching for bounces off support for now. SPX: 4350 top (4320 > 4330 resistance) / 4300 key level / 4250 bottom (4280 > 4275 support) Watching: SPY - Watching 430 - 429.61 for my main bounce. After that, 428.87 and 428.13. Above 432 for calls, I do not have much resistance until 435 TSLA - needs to break and hold 250 for a continuation up. |

|

|

|

|

|

#405 | |

|

Member

|

Quote:

There's your one good trade for the day if you caught it. This is the only A++ I've seen so far. TSLA - needs to break and hold 250 for a continuation up✅ - grabbed puts on the 250 reject off low volume. Up $137 per contract, a little lunch money to start the day.  Flow is up and down right now, only trade I'm looking for right now is calls @ 4300 into 4298 with confirmation. |

|

|

|

|

|

|

#406 |

|

Member

|

Got into 4310 calls when we broke above 4309 ATR band and volume was green. Stayed in for while watching SPX 5m candle go below and above ATR band, but didn't close below, so stayed in, finally sold for $170 profit (Blaze lunch money), so that I can get back to my regular job for now.

This was more to practice staying in a trade based on the SPX 5m not closing below my level. Something Blazed had mentioned last week.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#407 | |

|

Member

|

Quote:

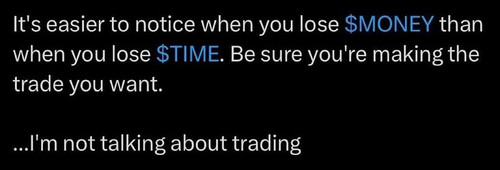

Trade recap: All done for the day. Only trade I took was TSLA for a $1,300 gain. Flow on SPX is up and down, looks like they're going to chop today. Good day for scalping if you like that type of trading. Puts on pops and calls on dips looks like it's been working out well.  Education: Just as a reminder: It takes months, even years to become a good trader depending on your mindset and how serious you take it. So it's important not to rush. If you rush your account goes to zero. If you don't have patience, your account goes to zero. If you're mad, your account goes to zero. If you're sad, your account goes to zero. Trading is a game of patience first, then the rest. Also, I saw this the other day, thought it was pretty cool.  Tomorrow will be a big day. |

|

|

|

|

|

|

#408 | |

|

Member

|

Quote:

Also glad to see you working on the patience, it will pay off big in the future when you start using real money and you'll stay in trades from level to level. |

|

|

|

|

|

|

#410 | |

|

Member

|

Quote:

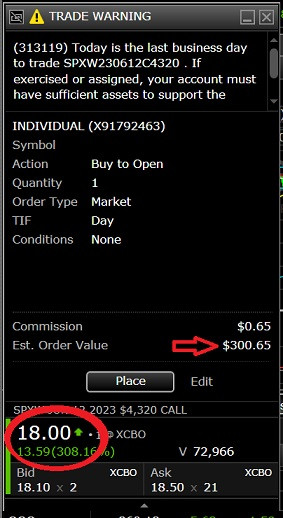

If anyone was paying attention and caught it congrats. Alert went off when we hit 4320. Touch of 4320 I took calls, they went from $300 > $1,800. All out @ 4338 as sellers stepped in and 4341 was the next ATR band. $15.3k on the day. Nice trade to end the day after getting chopped around all morning. Education: Education behind the trade - there's nothing technical about this. It was all 0dte driven. All 0dte gamma that was hedged and they had to unwind before eod. They gamma squeezed SPX with 0dtes, I don't remember seeing this ever happen before. It's like what they did to AMC and GME, but they're doing it to the S&P.... insanity.   ------------------------------------------------------------------------------------ Added: The first step is seeing it, if you don't understand greeks, now would be a good time to do a little reading up on them. It does help when you're able to recognize what's happening.

Last edited by Blazed; 06-12-2023 at 02:47 PM. |

|

|

|

|

|

|

#411 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#412 |

|

Member

|

Bottom 4300 (Support 4330 > 4320), Top 4400 (4375 Resistance), Key Level 4350

SPY Calls 430.5 (Don't have anything closer that I feel comfortable identifying) SPY Puts 445.5, 450 Edit: reversed Support/Resistance language.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 06-13-2023 at 08:29 AM. |

|

|

|

|

|

#413 |

|

Member

|

CPI came in under expectations. All the numbers are so rigged tbh, it's all pre planned so anyone with a brain should be able to see what's going on here. They should also be able to look around and see inflation isn't going down.

I will mainly be playing the ATR bands and focusing on intraday setups. Will mainly be looking for calls unless the market does some goofy stuff. This is where the market gets fun. SPX: 4400 top / 4350 key level (gap @ 4340.13) / 4300 bottom (4320 support) Anyone just learning or has a small account, good day to watch and learn. Anyone trading, good luck. A lot of greed in the market right now, so trade smart. |

|

|

|

|

|

#414 | |

|

Member

|

Quote:

|

|

|

|

|

|

|

#415 |

|

Member

|

Anything that would have made you take 4350 calls at the open? Just curious for my own learning? Volume specifically?

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#416 | |

|

Member

|

Quote:

Just following bands and volume today since we had data print. |

|

|

|

|

|

|

#418 |

|

Member

|

Got into 4365 Calls when SPX 5m candle close above, got out when the next SPX 5m candle closed below. Thought about grabbing 4365 Puts immediately, but didn't, would have been a good play. Did get into 4350 Calls at the reject of 4350, held until an earlier exit then I would have liked (had to leave), but was targeting 4365, would have played out nicely. Started they day down $200, ended up $170. My profits would have been better, but i lost about $100 from the time I decided to sell, enter the trade and hit execute, need put a market limit to sell so that its faster when I'm looking to take profits.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#419 |

|

Member

|

|

|

|

|

|

|

#420 |

|

Member

|

Blazed, I got a tradeview account, if you don't mind, what specifically do you use in tradeview? ATR, VWAP, supertrend? I know you use supertrend, but wasn't sure what else you use it for.

I wanted to see what you find is specifically useful for tradeview, then mimic that in addition into research, essentially through youtube, how to implement and test the indicators you use. Also need to research the functionality of tradeview as well, similar to what I did for ToS. Also, do you pay for any tradeview subscription? I'm messing around with it, and it seems like it only lets you do so much and then I keep getting a popup to subscribe, and I know your thoughts on paying for knowledge. Haha. Thank you in advance.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink Last edited by ajlaxmn; 06-13-2023 at 06:07 PM. |

|

|

|

|

|

#421 | ||

|

Member

|

Quote:

I use TV mainly to scan other tickers. I watch VIX/AAPL/TSLA/USOIL/E-MINI Futures/NQ/DIA just so I can see what the market as a whole is doing. I also use it for swings/leaps. That's basically it Quote:

Bold Yellow line is 100sma Bold Blue 5 ema Red 8 ema Bold Green 21 ema Bold Orange is basis Thin Green is supertrend support Thin Red is supertrend resistance That's it.

|

||

|

|

|

|

|

#422 |

|

Member

|

Watching market but likely not trading until FOMC. Statement @ 2 pm Powell @ 2:30 pm

New traders and small accounts, this is a good day to watch. If you do decide to trade not a good idea to do 0dte unless you're sized to 0. SPX: 4400 top (break above 4410) / 4370 key level / 4330 bottom (4350 support & gap @ 4340.13) Watching: SPY - bounce 436.6 for calls (High risk. Trying to catch an uptrend entry at this level). Or if we don't get the bounce, a break above 437.87 for calls. TSLA - TSLA filled the gap so I'll be watching for a continuation up. |

|

|

|

|

|

#423 |

|

Member

|

CPI came in lower than expected. FOMC today. We've been in an uptrend the past four days.

Bottom 4325 (4350 Support), Top 4425 (4000 Resistance > 4410), Key 4375 SPY Calls 435.5 - .7, 433.7 SPY Puts 437.7, 450

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#424 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

| Bookmarks |

|

|