|

|

|||||||

| Off Topic This section may contain threads that are NSFW. This section is given a bit of leeway on some of the rules and so you may see some mild language and even some risqué images. Please no threads about race, religion, politics, or sexual orientation. Please no self promotion, sign up, or fundraising threads. |

|

|

|

Thread Tools | Display Modes |

|

|

#1226 |

|

Member

|

OPEX this week, PPI, CPI.

Bottom 4550 (break 4540), Support 4570 & 4590, Key Level 4600, Resistance 4625, Top 4645 SPY 460.75 Reject, 464.6 Reject SPY 453.6 Bounce

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#1227 | |

|

Member

|

Not seeing anything I like. With FOMC Wednesday we'll see how the market moves today.

SPX: Key level of 4600 and ATRs are pretty much all I'm watching today. Ranges I'll watch: Top: 4640 Bottom: 4560 Quote:

|

|

|

|

|

|

|

#1228 | |

|

Member

|

Quote:

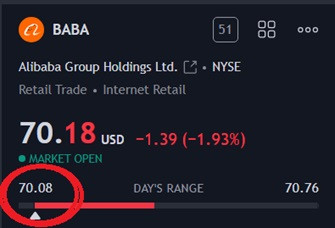

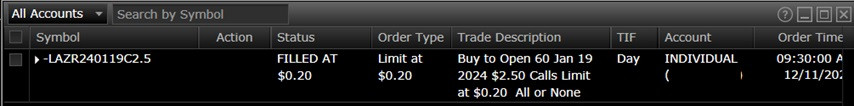

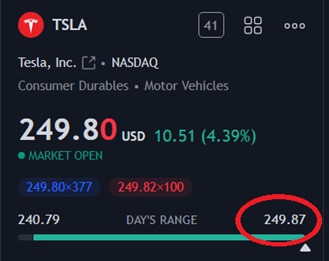

Calling it a day here. Might come back for power hour and see where we're at. Not looking to scalp and markets too choppy right now. Only 2 trades I've taken so far. BABA: getting close to my entry @ 70✅ - Filled 2k shares at my PT. Sold $70 puts 20 cons @ 9.50 for 1/17/25 for a $19k gain  Filled some LAZR on smaller acct. - contracts were the same price so I went a little further out. Alert set on options contracts @ +50% to see where we're at. No stops as option contracts spread gets wide at times, don't need any false stop outs. Lets see how this plays out

|

|

|

|

|

|

|

#1229 |

|

Member

|

Should be an interesting day today after that data drop.

After that data drop not expecting any rate cuts anytime soon. SPX: No levels today. Only watching whole psych #'s and ATR's today. 4615 key level - break below > 4600 is where I'll watch for a bounce. Watching: N/A Only trading strong signals today. Could be choppy today since tomorrow is FOMC. So no need to force anything or rush a trade. Let the trades come to you and have a plan before you get in. |

|

|

|

|

|

#1230 | |

|

Member

|

Quote:

Entered @ retest of ATR and trimmed @ last close ATR. Simple level to level trading. Looking for 4630/35 area for my runners.

|

|

|

|

|

|

|

#1231 | |

|

Member

|

Quote:

Looking for 4630/35 area for my runners✅- hit my price target all out here. Gains off this trade $9.6k Satisfied with the gains so calling it a day here.  Tomorrow is PPI & FOMC and Thursday is jobs and retail sales. |

|

|

|

|

|

|

#1232 |

|

Member

|

No trades today, away from home, same for tomorrow and Thursday, won't trade Friday as its OPEX, no real point for me to do so. I will follow. Back at it next week though.

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#1233 |

|

Member

|

FOMC today so not really watching anything prior. Mainly watching for bounces. That could change after opening bell though.

SPX: 4638 bounce area for calls is pretty much all I see. Watching: 462-462.5 area bounce for calls Simple watches today. Break below those levels I'll watch for confirmation of puts. |

|

|

|

|

|

#1234 |

|

Member

|

Market liked the rate decision.

Powell in 30. Just watching now, will trade when Powell speaks. I don't have any clear rejects for SPY until 470. SPX: Only watching whole psych #'s and ATR's. Not smart to trade this if small/new to trading. Should be fun. Lets see |

|

|

|

|

|

#1235 | |

|

Member

|

Quote:

------------------------- Just hit 470 in SPY and 4709 on SPX. Testing light puts here. |

|

|

|

|

|

|

#1236 | ||

|

Member

|

Quote:

Quote:

Just hit 470 in SPY and 4709 on SPX. Testing light puts here✅ Bang. 26 point drop to ATR level. Grabbed 4710 puts and exited @ 4683. Calling it a day here. $8.4k off the FOMC trade. Back at it tomorrow.  Volume - could see sellers stepping in when we hit a solid resistance level.  --------------------------------------------- I didn't take calls, but if you did it gave a nice bounce back up to 4700.  Back at it tomorrow. |

||

|

|

|

|

|

#1237 |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

#1238 | |

|

Member

|

Quote:

Market can only range so much per day, so he could have said next meeting they will cut rates .50bps and major reject areas would still play out. |

|

|

|

|

|

|

#1239 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#1240 |

|

Member

|

OPEX tomorrow.

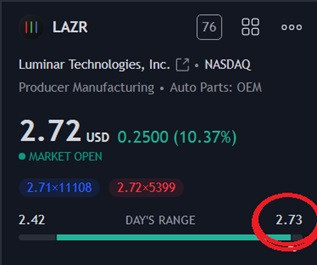

SPX: top 4750 (break above 4760) / bottom 4700 (break below 4695/90) / key level 4718 (GAP @ 4709.6) + ATR's Watching: SPY: bounce @ 469.7 area TSLA: looking for an uptrend entry @ break above 242.5 or a better R/R a break above 244. Looking for a move to 275 > 300 (not today but through Dec) Trade smart and let the trades come to you. Not really watching for rejects as of now. That could change intraday. |

|

|

|

|

|

#1241 |

|

Member

Join Date: Dec 2010

Location: Michigan

Posts: 10,010

|

Closed half of my LAZR calls for a 150% gain. Nice little trade there.

__________________

|

|

|

|

|

|

#1242 | |

|

Member

|

Quote:

AAPL hit 200 selling 15 -AAPL250117C215 contracts here for $23k. |

|

|

|

|

|

|

#1244 | |

|

Member

|

Quote:

Up $2.9k off this trade. Only trade I've taken so far. Waiting on SPX gap fill (4709.6) for calls with confirmation

|

|

|

|

|

|

|

#1245 | |

|

Member

|

Step away for a while and come back to a sell off. The market should be real fun next year lol.

Quote:

Dumb money (retail traders) will still continue to chase up here @ highs✅- they got smoked on that drop. Erased the whole bounce and then some. I didn't catch this move down, would have been a nice trade.   OPEX should be fun tomorrow. |

|

|

|

|

|

|

#1246 | |

|

Member

|

Quote:

Do you expect it to be as choppy as it has been on past Apex? Or do you expect some good moves I’ll probably follow, but if it starts out chopping in the morning, I may just call it a day. Sent from my iPhone using Tapatalk

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

|

#1247 | ||

|

Member

|

Quote:

Quote:

That said, I will be playing light size with profits from this week so if I take an L it won't be a big deal. |

||

|

|

|

|

|

#1248 | |

|

Member

|

Quote:

Still holding my full LAZR position as I think a break above 3.50 is doable. Gains for the day $26.4k (Includes the $215 APPL calls I sold) |

|

|

|

|

|

|

#1249 |

|

Member

|

Nice sell off for the AM expiration. OPEX + quad witching today.

SPX: key level 4730 (need to break and hold this to move higher). I'll also be watching SPX for a break below 4696 (support turned resistance) for a put entry. Watching: SPY: They front ran the bounce after the sell off premarket. So SPY bounce # yesterdays low I was watching is invalid now. TSLA: watching for a 245-246 area bounce. Next week contracts. Looking at the charts, higher time frames are looking for downside and lower time frames are looking for upside. No bias today, just take what the market gives. |

|

|

|

|

|

#1250 | |

|

Member

|

Quote:

__________________

Die hard Chargers Fan from the State of Maine. "Always with them negative waves"- Oddball "Uh-uh, I don't tip"- Mr. Pink |

|

|

|

|

|

| Bookmarks |

|

|